World Bank: Carbon prices in areas where carbon pricing mechanisms have been implemented

- Categories:Industry News

- Author:

- Origin:风能专委会CWEA公众号

- Time of issue:2021-05-25

- Views:0

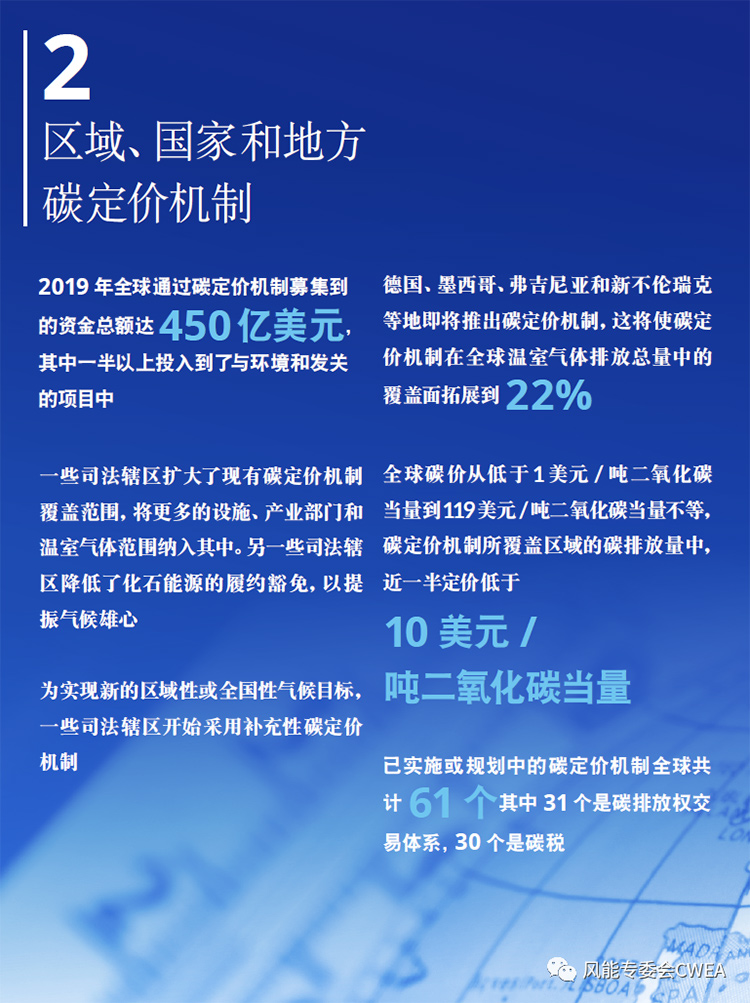

(Summary description)In recent years, carbon pricing policies have become an effective tool for more and more countries to encourage emission reductions.

World Bank: Carbon prices in areas where carbon pricing mechanisms have been implemented

(Summary description)In recent years, carbon pricing policies have become an effective tool for more and more countries to encourage emission reductions.

- Categories:Industry News

- Author:

- Origin:风能专委会CWEA公众号

- Time of issue:2021-05-25

- Views:0

In recent years, carbon pricing policies have become an effective tool for more and more countries to encourage emission reductions. Carbon pricing actually sets a price for carbon dioxide emissions, and through the use of price signals, economic entities can reduce carbon dioxide emissions, or pay for carbon dioxide emissions, so as to guide production, consumption and investment to transition to a low-carbon direction, and achieve response to climate change and the economy. The coordinated development of society.

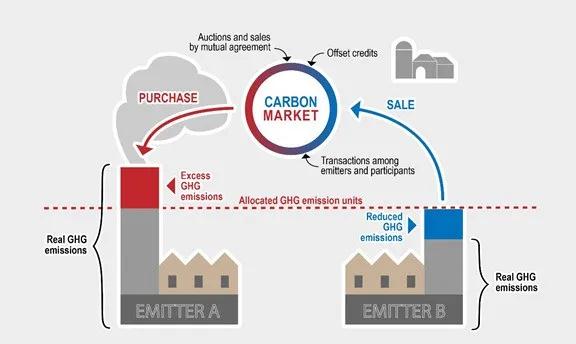

Carbon pricing mainly includes two forms: Carbon Tax and Carbon Emission Trading (ETS). The former refers to the taxation of carbon dioxide and other greenhouse gas emissions, and the latter refers to the classification and trading of corporate carbon dioxide emission quotas. The specific policy implementation varies among countries and regions. As many countries around the world have proposed carbon neutrality goals, carbon pricing policies have continued to be mainstreamed and have become a hot spot for all parties.

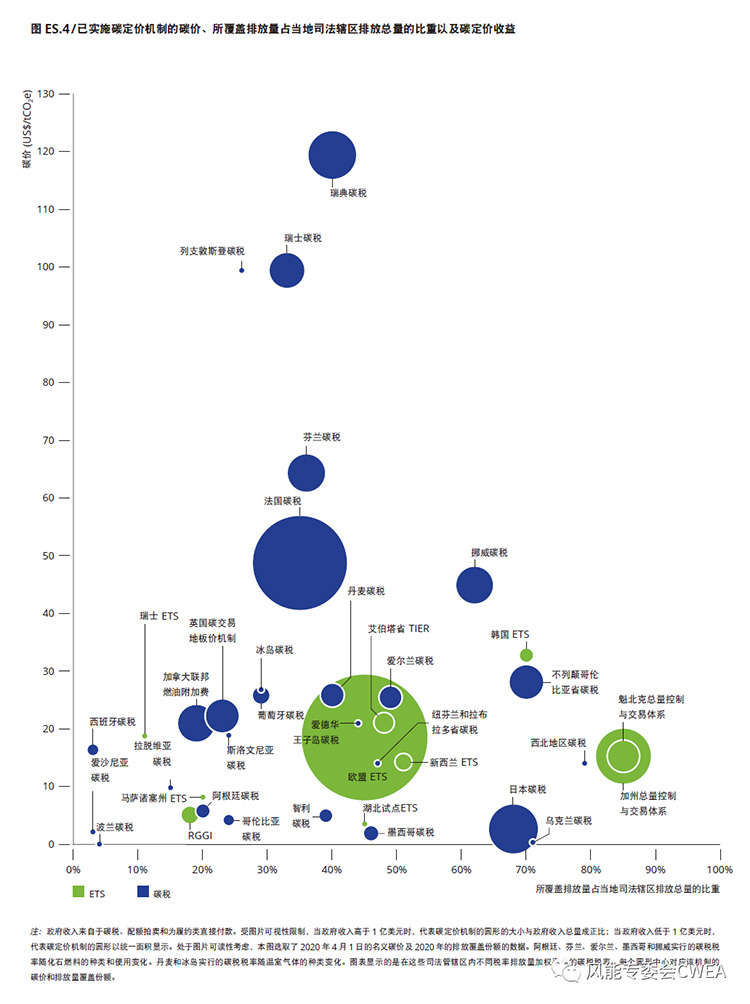

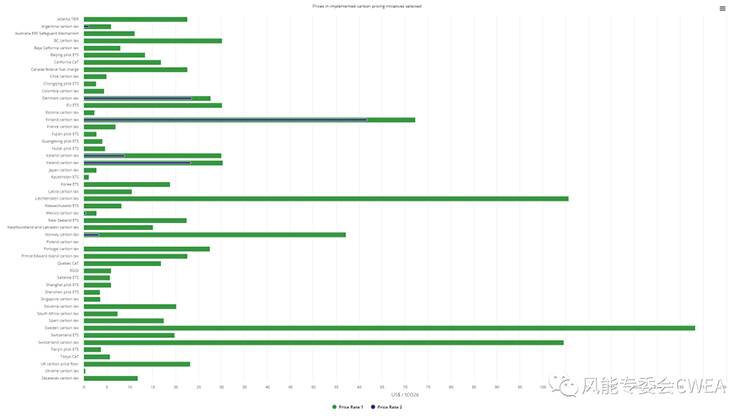

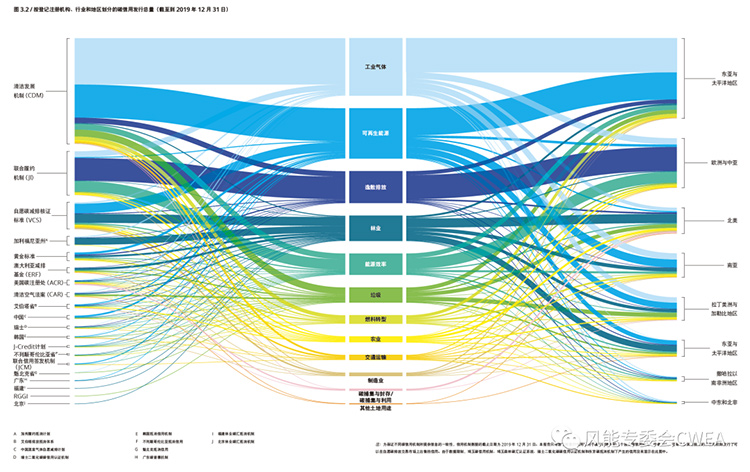

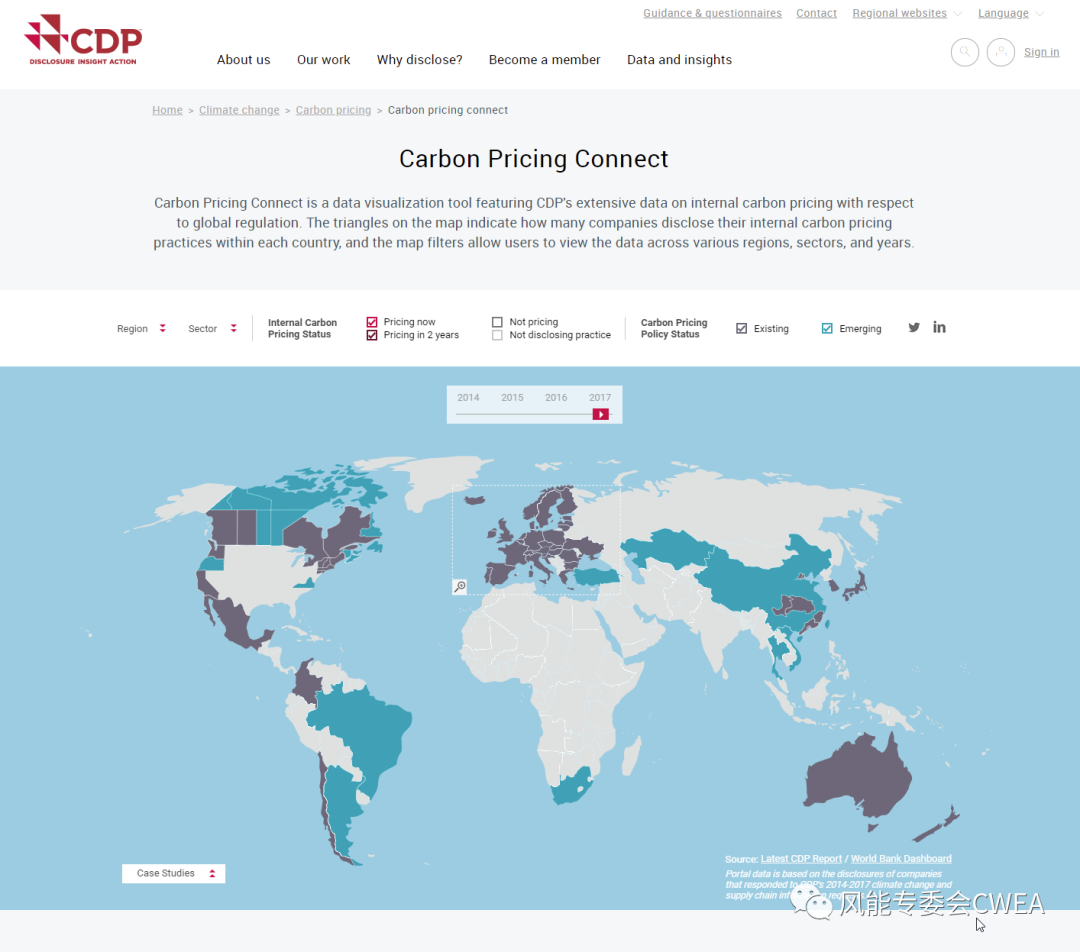

The picture below shows the distribution of carbon prices in countries and regions that have implemented a carbon pricing mechanism released by the World Bank.

High-carbon industries will lose their competitive advantage in the global trading system

Entering 2021, the game of carbon pricing power will become one of the important content of the game among major powers. Currently, carbon pricing varies widely among countries, and the average price is low. According to estimates by the International Monetary Fund, the global average carbon price is only US$2 per ton. The World Bank's 2020 report shows that global carbon prices range from less than US$1 per ton of carbon dioxide equivalent to US$119 per ton of carbon dioxide equivalent. Nearly half of the carbon emissions in the regions covered by the carbon pricing mechanism are priced below 10%. USD/ton.

China is also experimenting with carbon prices, but they are significantly lower than those of the EU. The EU passed the "carbon border adjustment mechanism" in March, and soon the EU will impose "carbon tariffs" on products from other countries. A specific method will be proposed in June this year, and it may be formally expropriated in 2022. Among them, China's steel and cement industries are facing huge risks.

Because China's export market is mainly in Europe and the United States. However, high-emission manufacturing products such as steel and chemicals account for the majority. The carbon border adjustment mechanism will add new barriers to China's exports to the EU.

However, carbon pricing will also force China's high-carbon industries to adjust, which will not only protect the domestic ecological environment, but also enhance future trade advantages. For foreign research institutions, the short-term impact of carbon tariffs on China's industries will be great, which will affect employment. But in the long run, China will increase its competitiveness by accelerating the development of a low-carbon economy. Through the internal cycle, the green and low-carbon economy will be the new engine of China's economy. Vigorously developing renewable energy sources will not only allow China to firmly control energy security in its own hands. And no country has the potential to become the world's green technology superpower more than China.

Carbon Tax

Carbon tax is a taxation method that converts the environmental costs caused by carbon dioxide emissions into production and operation costs. According to World Bank statistics, as of June 2020, more than 30 countries and regions have implemented carbon tax policies, covering developed and developing countries across all continents, covering a total of 30 billion tons of carbon dioxide emissions. In addition, among the 185 parties to the Paris Agreement that have established nationally determined contributions, 97 parties have proposed that they are planning to use or consider using carbon taxes and carbon emission trading to fulfill their nationally determined contribution commitments.

Carbon tax mainly has the following advantages: First, it takes effect quickly, can directly increase the cost of greenhouse gas emissions, quickly squeeze the profit margins of resource-intensive enterprises, and force them to adopt energy-saving and emission-reduction measures or limit heating, and achieve substantial reductions in a short period of time. Row. The second is the low cost of implementation, mainly relying on the existing taxation system for implementation, without the need to set up new institutions, and do not need to consider issues such as supporting infrastructure. Third, the tax rate is stable, forming a stable carbon price expected guideline, and companies can arrange mid- and long-term emission reduction plans. Fourth, the redistribution of income can be realized. The government can use carbon tax revenue for green project construction or new energy technology research and development to support low-carbon transition. However, we need to realize that the carbon tax is insufficient to control the total amount of carbon emissions. If the carbon tax rate is relatively low, high-emission, high-yield companies can maintain their original production and business models, and their willingness to reduce emissions is low.

Due to differences in economic structure, emission reduction targets, etc., the development of carbon tax in various countries is quite different, but in practice there are still commonalities, which are mainly reflected in the tax system design, tax base, tax rate, tax use, and implementation of carbon tax. Effects and other aspects.

Carbon Emission Trading System (ETS)

Since the EU launched the world's first carbon emission trading market in 2005, the global implementation of ETS has continued to expand. Up to now, there are 21 national and regional ETSs in operation around the world, 8 are under planning, and 16 have put forward preliminary ideas. The annual carbon dioxide emissions covered by the 21 ETS are approximately 4.3 billion tons, accounting for about 9% of the global annual emissions. Among them, ETS with relatively mature operating mechanism and larger transaction scale include EU ETS in the European Union, California ETS in the United States, and the Regional Greenhouse Gas Initiative (RGGI) in the United States.

ETS has three main advantages. First, the effect of emission reduction is deterministic. Under the ETS system, the government directly determines the total amount of carbon emission allowances within a period of time, that is, the maximum amount of carbon dioxide emissions, so the emission reduction results are more intuitive and clear, and other intermediate variables are not required for transmission. The second is to encourage enterprises to reduce emissions through price means, and has a relatively complete price discovery mechanism. In addition to regular quota transactions, ETS can also carry out derivative transactions such as quota futures and options to further improve market efficiency. The third is to promote the coordination of cross-border emissions reductions. Different ETSs can achieve interconnection and form a cross-border and cross-regional carbon emission rights market. After the connection, ETS can optimize emission reduction arrangements on a larger scale and at the same time improve market liquidity. However, we need to see that ETS is difficult to design and operating costs are high. The determination of key parameters such as emission quotas can only be determined by estimation, and unexpected situations are difficult to foresee, and it is difficult to ensure that ETS advances as planned. The government needs to continuously monitor and evaluate the operation of ETS and make corresponding adjustments, which requires a large amount of administrative resources.

Scan the QR code to read on your phone

Recommended news

Shenyang Shenggongyi Technology Co., Ltd.

Tel:400-110-0397

Phone:16261590999(Mr song)

Phone:15825775918(Mr song)

E - mail:sgykj@sgy7777.com

QR code

Mobile

Messages

Copyright (C) Shenyang Shenggongyi Technology Co., Ltd. All rights reserved. 辽ICP备18002310号 Powered by 300.cn